Estate Tax Limits 2025. Typically, heirs won’t pay the federal estate tax unless the value of your estate exceeds the exemption amount. States with estate or inheritance taxes.

The estate tax ranges from rates of 18% to 40% and generally only applies to assets over $13.61 million in 2025. Right now, you may give an unlimited number of people up to $17,000 each in a single year without taxes.

Right now, you may give an unlimited number of people up to $17,000 each in a single year without taxes.

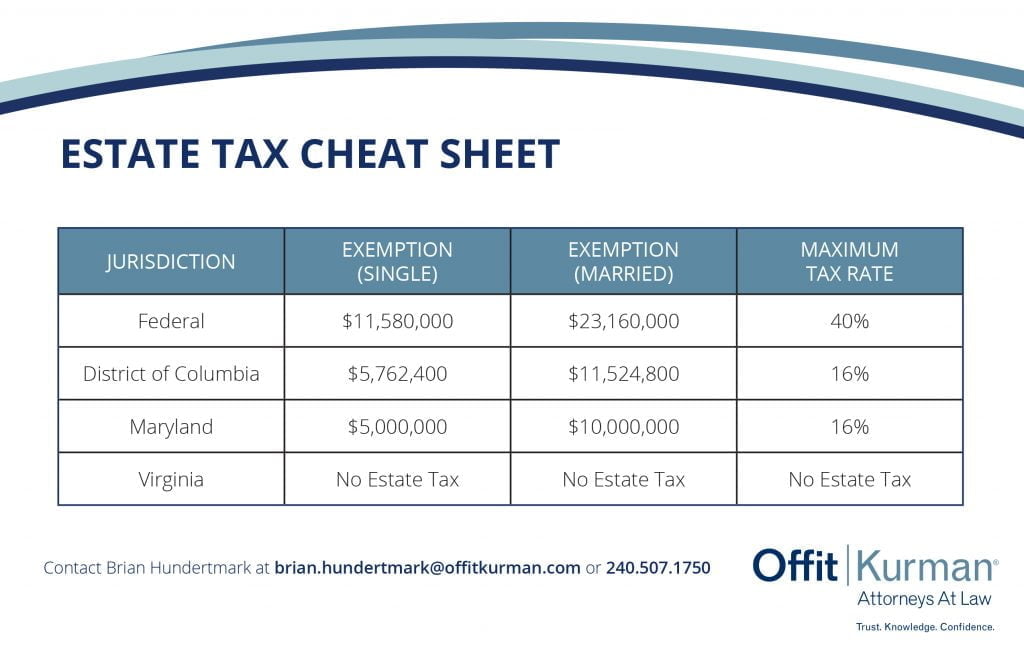

2025 Tax Cheat Sheets, The annual amount that one may give to a spouse who is not a us citizen will increase to $185,000 in 2025. The top tax rate applicable to estates and living gifts will be subject to a maximum tax rate of 40%.

Estate Tax Free of Charge Creative Commons Green Highway sign image, In 2025, the estate and gift tax exemption amount is $12.92 million per person (or $25.84 million per married couple). Typically, heirs won’t pay the federal estate tax unless the value of your estate exceeds the exemption amount.

2016 Estate Tax Update Fairview Law Group, Thirteen states levy an estate tax. What is an estate tax and a gift tax and how are they different?

New Estate Tax Limits Highlight Need to Plan Tucson Elder Law Attorney, So the rogue will be. It also made inflation adjustments to contributions limits for.

IRS Here are the new tax brackets for 2025 Economics, Applies to taxable income between. The estate tax exemption is adjusted annually to reflect changes in inflation each year.

Estate and Gift Tax Update for 2025 / Minnesota Estate Tax Everything, This annual limit is a key factor in tax. The tcja is set to expire at the end of.

Estate and Gift Tax Limits for 2025 Schultz Financial Group Inc., Right now, you may give an unlimited number of people up to $17,000 each in a single year without taxes. Estate and gift tax planning:

Gift Tax Limit 2025 Explanation, Exemptions, Calculation, How to Avoid It, The estate tax ranges from rates of 18% to 40% and generally only applies to assets over $13.61 million in 2025. Estate and gift tax planning:

Estate Tax Exemption and Annual Gift Tax Exclusion for 2025 Scott, The top tax rate applicable to estates and living gifts will be subject to a maximum tax rate of 40%. The federal estate tax exemption for 2025 is $13.61 million.

What is my ESTATE TAX bill going to be? Strohmeyer Law PLLC, There could also be increases for inflation for. The timing and extent of potential changes to gift and estate tax laws are.